Interesting Online Food Ordering Statistics For 2024 That You Need To Know

September 13, 2024

—

Statistics on Online Food Ordering: The COVID-19 pandemic turned out to be advantageous for both restaurants and companies offering online food delivery. Due to restrictions and lockdowns caused by the virus, restaurants had to halt in-house dining and pivot to online delivery services.

Furthermore, with many of us working remotely, we increasingly opted to order food via our personal computers and smartphones instead of cooking ourselves. According to Zomato, Deliveroo, Uber Eats, Foodpanda, and DoorDash, there has been a remarkable increase in online orders.

For those interested in understanding the most popular applications, emerging online delivery trends, the value of the industry, and more, we’ve put together a collection of compelling online food ordering statistics.

You might also find interest in these statistics regarding the operating hours of nearby grocery stores.

Now, let us delve into the online food ordering statistics.

Essential Online Food Ordering Statistics (Editor’s Choice)

It is anticipated that in 2023, revenue from online food ordering will account for 40% of restaurant sales, amounting to $220 billion by year’s end.

The number of direct online orders has seen an increase of 54%.

Conversely, 56% of restaurants and customers are utilizing restaurant apps for online food ordering.

In the United States, 62% of customers reported ordering food at least once a month, with online food ordering being accepted by 78% of the population.

Moreover, 60% of consumers in the U.S. now place takeout or delivery orders at least weekly.

Approximately 6,852 delivery workers are needed to satisfy the U.S. market’s pizza demand, amidst online spending growth of 18%.

As of 2023, there were 6 million users of food delivery applications in the U.S.

In 2023, the global market for food delivery services reached a value of $143.05 billion.

Interestingly, 46% of online orders include some form of offer, discount, or coupon.

The inaugural meal delivery application was launched in 1995.

Notably, almost 20% of customers report that they spend more on off-premise orders compared to traditional dine-in meals.

During the COVID-19 pandemic, 58% of individuals expressed reluctance to dine in restaurants.

In the U.S., 60% of consumers place weekly takeout or delivery orders.

One-third of customers are willing to pay extra for quicker delivery.

The meal-kit industry is experiencing growth in the United States.

By 2030’s conclusion, the online food delivery market is expected to reach a worth of $365 billion.

31% of respondents say they utilize third-party delivery services at least twice weekly.

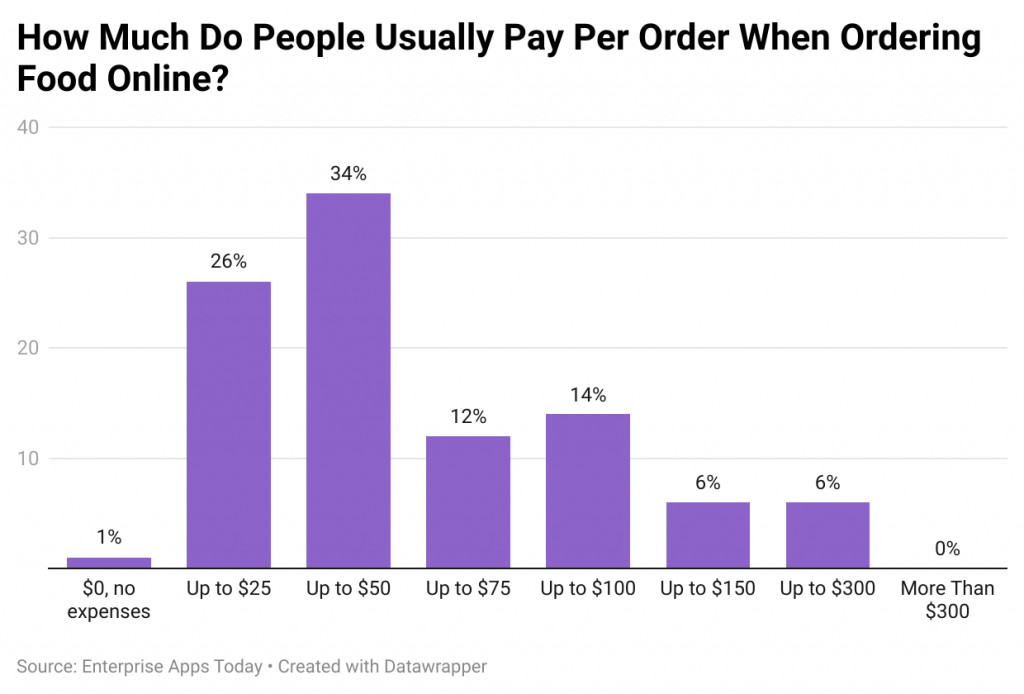

34% of customers report spending $50 on online food orders.

20% of consumers feel they end up spending more when ordering off-premises compared to standard dine-out experiences.

57% of millennials have opted for delivery from restaurants to enjoy TV or movie nights at home.

Delivery and takeout represent 59% of restaurant orders among millennials.

By the conclusion of 2029, the food delivery app industry is projected to reach $165 billion.

“`html

In 2023, the estimated figure for placing orders through mobile apps and smartphones will reach $52 billion.

A 45% majority express a preference for mobile ordering or loyalty programs to enhance their online shopping frequency.

Collaborating with a third-party service provider can significantly boost restaurant sales.

60% of restaurant owners report that providing delivery services has resulted in increased sales.

33% of consumers are open to paying a higher fee for quicker delivery options.

Why do People Order Food Online?

Avoiding cooking makes online food ordering an ideal choice. Recent studies indicate that nearly all customers use an app for mobile food orders. The online food delivery phenomenon is transforming the global food industry. Initially, this trend emerged in urban settings but has since extended to other regions.

This expansion can be largely attributed to our fast-paced corporate society, where convenience often outweighs everything else, making doorstep delivery a profitable solution. Individuals working traditional hours, students, and remote workers often find themselves at risk of consuming unhealthy and unsanitary meals.

The traditional image of women cooking at home is gradually being overtaken by those who are more driven, competent, and aspirational.

People constantly seek out new tastes, exquisite cuisines, and delectable dishes. The abundance of variety offered leads many to opt for online food delivery, allowing them to have their preferred dishes conveniently brought to their doorsteps. Food has a unique way of creating connections among individuals.

The framework for online food ordering is structured to foster a favorable perception of its advantages, including varied payment choices and enticing promotions.

Food Delivery Statistics Based on Different Models

Aggregator Food Delivery Model:

Food delivery partners have multiple models through which they can profit. Delivery services that outsource their deliveries typically generate about $121.29 for each customer. Aggregators oversee the food delivery process that the restaurant is responsible for. The aggregator ordering app enables patrons to order from numerous restaurants through a single portal. Customers can log into the app to browse menus and prices, compare costs, and read reviews.

Aggregators earn a predetermined profit per order, compensated by the restaurant. The app takes care of the delivery logistics, ensuring customers don’t incur additional fees and can place orders with ease. This model provides aggregators with a margin ranging from 40% to 50%, not taking into account interest or taxes.

Restaurant’s Own Delivery Model:

Restaurants managing their own deliveries reap $184.18 for each order.

They can reduce delivery expenses by up to 30% through in-house delivery. This segment, identified as the restaurant-to-consumer model, is experiencing growth.

Restaurants that deliver independently tend to experience revenue growth somewhat more rapidly. Those with their own delivery services observe a revenue increase of $12 per customer, in contrast to $8 for customers relying on external deliveries.

Understanding customer behaviors is crucial before developing an online food ordering application.

New users on online food delivery platforms may possess varying expectations regarding quality and delivery speed. Here are some examples.

Online ordering is sticky: If customers have learned about your online meal-ordering app, they are likely to register. Once accustomed to your app, 80% may seldom or never explore alternative platforms. In such cases, the app secures an advantage. The entity that gathers the most user sign-ups in the least amount of time reaps the benefits.

Delivery times: The speed of delivery is

“`

Customer satisfaction hinges significantly on delivery speed, as many customers switch platforms due to inadequate delivery times. A staggering 60% across various markets indicate that delivery speed is a crucial determinant of their satisfaction. Ideally, the maximum wait time should be capped at 60 minutes.

Home Meal Orders: Recent studies reveal that approximately 82% of orders come from home, while 15% of customers place their orders from work.

Weekend Orders: The highest volume of online orders occurs on Fridays, Saturdays, and Sundays, with a notable increase of 74% in orders during these days.

Online food delivery has evolved into a significant industry. As the food sector continues to expand daily, understanding and meeting customer needs is essential for future success. Prior to making any business decisions, consider all available online food ordering statistics. Additionally, continuously seek opportunities to grow your business and enjoy the benefits.

Market Size of the Online Food Ordering Industry

In the United States, food delivery revenue has seen a threefold increase over the past five years. Back in 2015, 66 million individuals ordered food delivery worth $8.7 billion. By the year 2020, this figure had surged to $26 billion and involved 111 million users.

There’s no sign of the food delivery industry in the United States slowing down. Predictions suggest that by 2025, the market will soar to $43 billion. The potential for these industries appears limitless.

As of March 2020, 38% of food enthusiasts in the US were ordering their food via company apps, with the number rising to 60% by March 2023. This illustrates the profound impact the pandemic had on the food delivery sector.

The presence of food delivery is now firmly established. In 2023, 53% of participants in surveys – including 64% of millennials – declared that food delivery and takeout are “essential” to their lifestyle.

Research conducted by the National Restaurant Association in May 2023 found that around 70% of individuals opt for food deliveries for dinner, while 47% prefer ordering during lunch hours.

A substantial portion of the US populace is engaged in online food ordering. According to Gloria Foods research, 86% of US consumers have placed at least one order online in a given month.

The pandemic has reshaped customers’ dining and ordering behaviors. In 2021, 68% of consumers indicated they were more inclined to order takeout compared to their experiences during the pandemic.

Although businesses focused on food delivery have experienced significant growth recently, a considerable number of customers still favor dining in restaurants. By the closure of 2023, revenue from restaurants delivering directly to customers is projected to reach $1.02 trillion, with online ordering revenue expected to hit $100 billion.

Research focusing on demographics and regional demand for online food orders indicates that US consumers prefer ordering directly from restaurants when given the choice.

In response to the market shifts post-pandemic, restaurants adapted swiftly. Of those surveyed, 81% of venues with exceptional dining spaces and 78% of family-friendly hotels reported impacts. Additionally, 77% of casual or generic hotels began incorporating curbside service into their operations starting March 2020. Nearly half of these establishments expanded their food delivery options.

Leading Food Delivery Services

(Source:businessofapps.com)

The projected market size of food delivery in 2023 is expected to reach $100 billion.

In addition, anticipated figures for the following years include 2024 ($108 billion), 2025 ($117 billion), 2026 ($127 billion), 2027 ($138 billion), 2028 ($151 billion), and 2029 ($165 billion).

By the start of 2023, the most popular downloaded applications were those that facilitate online food orders and home deliveries. In 2023, Delivery Hero achieved 65.9 million downloads globally, while Zomato reached 60 million downloads.

Following these, other food ordering apps saw downloads as follows: Uber Eats (50 million), DoorDash (40.8 million), Swiggy (36.9 million), Just Eat Takeaway (31.8 million), iFood (18.6 million), Getir (17.5 million), Deliveroo (11.6 million), Instacart (10 million), and GoPuff (5.3 million).

At the close of 2023, Uber Eats acquired Postmates for $3,057 million.

Uber Eats charges a commission ranging from 20%-30% for each order made. Despite this, the company remains unprofitable. In the first quarter of 2023, Uber Eats reported mobility rates of $4.33 billion and delivery rates of $3.09 billion.

Conversely, in the second quarter of 2023, the mobility and delivery rates recorded by Uber Eats were $4.89 billion and $3.05 billion, respectively.

As of 2023, Uber Eats boasts nearly 88 million annual users.

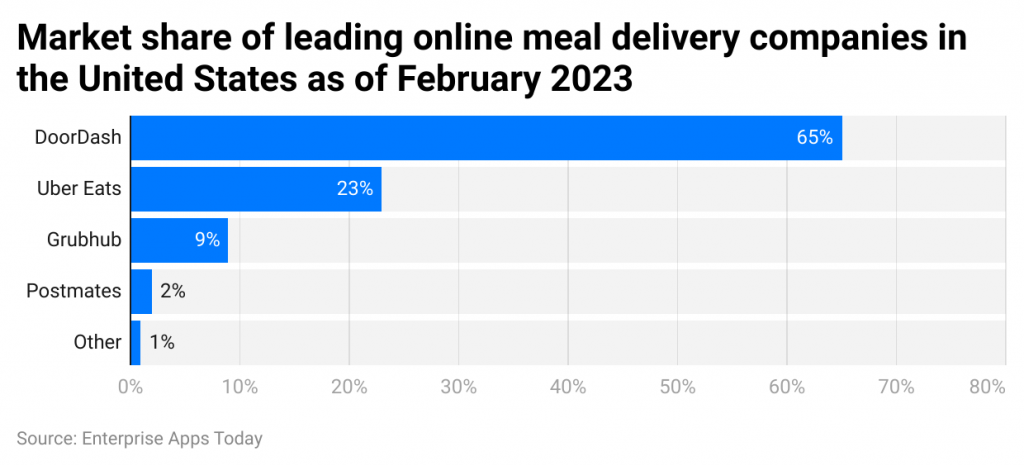

In 2020, DoorDash surpassed Uber Eats to become the leading food delivery company in the United States, securing a 45% market share by the end of that year. Meanwhile, Uber Eats held a 22% market share, Grubhub had 18%, and Postmates accounted for 8%.

This rapid ascent is noteworthy; DoorDash had only a 5% market share in US food delivery as of 2015, with revenues close to $3 billion.

Variances exist in the percentage of food delivery services across different cities. For instance, DoorDash represented 82% of San Francisco’s food delivery sales in March 2023, while Uber Eats led Miami with 55%. In Los Angeles, Postmates dominated with a share of 32%, leaving the remainder at just 5%.

By the end of 2020, Uber Eats was operational in approximately 1,000 cities and aimed to expand to 6,000 locations worldwide by 2023.

Globally, it ranks as the most popular food delivery service based on user numbers, with over 88 million users in 2023. DoorDash is particularly prominent in the US, servicing around 18 million users.

However, many individuals who utilize food delivery apps do not remain loyal to them. Customers of Uber Eats, Grubhub, and Postmates showed preference for Delivery Shipping in the first quarter of 2021.

Online Food Ordering Statistics and Facts

“`html (Source: savemycent.com)

(Source: savemycent.com)

By 2023, nearly 26% of individuals utilized applications for online food ordering, spending up to $25 on each order.

Conversely, the statistics for per order payments indicate that 34% of individuals spend $50, 12% allocate $75, 14% exceed $100, 6% spend up to $150, another 6% go up to $300, while 1% report no orders.

Over the last several years, there has been significant growth in the food delivery market. It’s unsurprising that ordering food online is quick and easy, and it allows those with social anxiety to avoid interacting with others.

Now, let’s delve into some of the latest Online Food Ordering Statistics.

#1. The likelihood of ordering food online diminishes with rising income.

Analysis of online food delivery app users by income reveals that 51.6% of those earning under $10,000 annually are more frequent in their online food orders.

Conversely, the statistics indicate that increased income correlates with reduced usage of food delivery apps. Hence, as average income climbs, the percentage gradually decreases, resulting in only 25.3% of individuals earning between $150,000 and $175,000 utilizing food delivery applications.

This number rises afterward; however, only 39.6% of those with incomes over $200,000 use these apps, remaining below the previously mentioned 51.66%.

(Source: Zion and Zion)

#2. In the United States, 60% of consumers now place takeout or delivery orders weekly.

This is not a typo. Americans take pleasure in ordering food, be it delivered from restaurants or takeout, and their frequency appears to be increasing.

Data from food delivery applications shows that user numbers have nearly doubled over the last five years.

In 2015, the nation had merely 66 million users, with a gradual yearly increase.

However, the COVID-19 pandemic significantly boosted the food delivery market, adding 16 million new users within a single year. This brought the total to 111 million people in the US utilizing food delivery services in 2020.

Moreover, consumers do not seem reluctant to spend on this service—34% claim they typically spend at least $50 on each order, which exceeds their usual expenditure when dining out.

(Source: Business Of Apps)

#3. Approximately 6,852 delivery workers labor intensely to meet the demand for pizza in the US market.

Pizza delivery statistics indicate that the average pizza delivery driver is likely a 47-year-old white male.

Interesting fact: While pizza delivery drivers can earn more than $49,000, their average salary hovers slightly below $33,000.

(Source: Zippia)

#4. Younger individuals are more likely to utilize food delivery services.

Turning our attention to food delivery demographics:

As of 2023, about 60% of online users aged 18–24 reported having ordered food online. This same…

“`

For approximately 52% of online users aged in their twenties or early thirties.

As age increases, the percentage of usage gradually decreases. For instance, only 17% of online users exceeding the age of 65 use online food ordering services.

Interesting fact: Around 57% of millennials opt for meal orders when planning to watch movies and TV series at home.

(Source: Gloria Food)

Food Delivery Application Industry

Were you aware that the first documented occurrence of food delivery dates back to the 18th century?

According to historical accounts, during their visit to Italy, Queen Margherita of Savoy and King Umberto I ordered three pizzas.

The famous pizza maker Raffaele Esposito delivered the pizzas and named the queen’s favorite pizza in her honor.

Since that time, the food delivery sector has evolved tremendously, supported by various statistics.

#5. Grubhub remains operational as demonstrated by its statistics.

Despite tough competition from DoorDash and Uber Eats, Grubhub’s customer base continues to grow.

In 2023, Grubhub recorded an average of 300 million daily orders with 31 million customers, showing a notable increase from 26.5 million members and 492,300 daily orders in the previous year.

Nevertheless, Grubhub’s market share in food delivery has declined to just 18%, and the company faces its lowest annual losses ever (-$155 million).

(Source: Business of Apps)

#6. The global market for food delivery services was valued at $115.07 billion in 2020.

Industry statistics reveal that worldwide online food delivery services generated

approximately $143.05 billion in revenue for 2023.

Recent estimates suggest that the year will conclude with revenue exceeding $159.46 billion, reflecting a global annual growth rate of 2.8%.

If the current trends persist, it’s projected that by 2024, the global food delivery industry will pull in $183 billion in revenue, and by 2025 it will reach a market value of $192 billion.

(Source: PR Newswire)

#7. Consumers who order pizza online typically spend 23% more than those ordering by phone.

While this research focused mainly on pizza restaurants, it’s reasonable to infer that online customers generally spend more than those placing orders over the phone. Online orders easily include extras such as platform fees, delivery charges, driver tips, and other upcharges. Even with these additional costs, customers continue to place orders online, indicating a willingness to pay for convenience.

(Source: pizzasales.com)

#8. DoorDash is the leading food delivery service in San Francisco.

Given its San Francisco origins, DoorDash commands a significant portion of the food delivery market in the area. Remarkably, DoorDash captures about 65% of food delivery sales in San Francisco.

In contrast, Uber Eats, another large company based in the Bay Area, only accounts for 14% of food delivery sales.

(Source: Statista)

#9. As of 2023, Postmates is the most recognized food delivery service in Los Angeles.

In Los Angeles, where numerous providers compete for sales, Postmates stands out as the most recognized food delivery service. It accounts for only 48.6% of the city’s food delivery sales.

Moreover, Postmates is prevalent on the West Coast, highlighting its minuscule 1% market share in the significant East Coast market of Philadelphia.

(Source: Statista)

#10. The inaugural meal delivery app was launched in 1995.

This was the website waiter.com created by WorldWideWaiter, which back then allowed food ordering from 60 restaurants.

Prior to the launch of waiter.com, however, the first instance of online food ordering had already occurred.

Pizza Hut established a different website known as PizzaNet, marking the beginning of online food orders.

an online customer has ordered a large mushroom and pepperoni pizza with extra cheese.

#11. DoorDash continues to lead the market in the US.

(Source: statista.com)

(Source: statista.com)

A few years back, the competition for national market supremacy between DoorDash and Uber Eats was intense; however, that is no longer the case. While internationally, Uber Eats is recognized as the top restaurant delivery service, the scenario in the United States differs significantly.

As of 2023, DoorDash commands 65% of the US online meal delivery market, with Uber Eats holding the second spot at 23%.

Following them, Grubhub has a market share of 9%, Postmates comes next at 2%, and other applications collectively account for 1%.

#12. The US food delivery market generated $26.5 billion in revenue in 2020.

It’s quite an understatement to claim that the food delivery sector has grown, given that its annual revenue has more than tripled within five years. In 2015, the industry in the US generated only $8.7 billion, which increased to $16.8 billion in 2018, and suddenly surged by another $10 billion in 2020.

It’s truly remarkable how the pandemic has propelled the expansion of food delivery.

Forecasts prior to the pandemic estimated that online food delivery would account for just 9% of the US restaurant market in 2021, but the pandemic has driven growth of an additional 4% in the sector.

Currently, predictions suggest that online food ordering will represent 21% of the US restaurant market by 2025.

(Source: Business Of Apps)

#13. Uber Eats is the most popular food delivery app outside the US.

Determining the top food delivery app for consumers can be tricky as it often depends on personal preference and geographical factors. Nonetheless, there’s no disputing that Uber Eats stands out as the most recognized service globally.

The app holds approximately 29% of the global market share and boasts 66 million users. It’s available across 6,000 locations in 45 countries and partners with over 600,000 restaurants.

Fun fact: Despite its annual revenues nearing $5 billion, Uber Eats has yet to achieve profitability. However, statistics reveal that the company has consistently lowered its annual losses over recent years. If the current trend continues, it may eventually reach profitability.

(Source: Business of Apps)

Trends in Online Food Ordering

What does the future hold for food delivery applications? What kinds of innovations are being introduced? Who are the other competitors in the online food ordering landscape?

Let’s explore further.

#14. The food delivery industry in China is flourishing.

With over 500 million online users, China leads the world in online food delivery, with more than 40% utilizing various apps to order food.

By the conclusion of 2028, the

The online food delivery market is projected to generate a total revenue of $129.6 billion.

Statistics regarding online food ordering indicate that in China, approximately one-third of the population favors ordering meals over dining out.

In the Asian nation, the primary players are Alibaba’s Eleme and Tencent’s Meituan. Both applications promote sustainable packaging, offer impressively low rates, and integrate with digital payment platforms such as Alipay. Quite impressive, isn’t it?

(Source: Statista)

#15. Automated delivery? On the horizon.

In 2019, prominent companies began exploring automated delivery options for their food services. Rumor has it that Chipotle and Domino’s are showing interest in Nuro’s self-driving vehicles, while Chick-fil-A appears to favor Kiwibot’s delivery robots.

What about using drones for food delivery?

Uber had been in the process, but the initiative was transferred to Flytrex. Recently, the firm formed partnerships with El Pollo Loco, It is Just Wings, and other national restaurant chains, although details remain sparse.

(Source: Forbes)

#16. Online grocery shopping is more popular now than ever.

Not everyone opts for restaurant orders. There is an app available for nearly anything, allowing you to even have your favorite alcoholic beverages or grocery items delivered to your door.

Grocery delivery statistics reveal that the industry’s monthly revenue in the US surged from $1.2 billion in August 2019 to $6.4 billion by October 2021.

Current projections suggest that the online food and beverage industry is set to produce $25.7 billion in annual revenue by 2025.

(Source: Statista)

#17. Certain food delivery apps are embracing cryptocurrency.

In some regions, it’s possible to order food using cryptocurrencies. For instance, Shuttledelivery in South Korea, Lieferando.de in Germany, and Takeaway in the Netherlands allow you to place online food orders and pay with Bitcoin.

Indeed, cryptocurrencies are steadily gaining traction and recognition as a valid payment method, particularly in the food industry.

Following the official recognition of Bitcoin by El Salvador, major restaurant chains such as McDonald’s, Pizza Hut, and Starbucks have started accepting payments in Bitcoin.

(Source: Bloomberg)

#18. The meal-kit industry is experiencing growth in the United States.

You might be surprised by the number of people who have at least experimented with this type of food delivery. For instance, 25% of urban residents, 29% of millennials, and 23% of men have tried meal kits.

Current estimates place the meal kit market at approximately $5 billion, with predictions that it could reach $11 billion in 2022.

(Source: Linch Pin SEO)

Direct Orders Placed with Restaurants

According to a report by Starbucks, 25% of their sales are conducted through mobile applications.

Uber clearly leads the mobile ordering market, while Domino’s has seen an increase in sales through their app.

Mobile applications have become so widespread that roughly 60% of orders are placed via these platforms. Food companies must focus on ensuring their apps and websites are digitally accessible, including clarity and resolution for food items, pricing, and promotions.

Restaurants such as Chipotle and Burger King have customized their delivery and pick-up processes to address the growing demand.

The global food service market value was approximately $2,902.1 billion in January 2023 and is projected to reach $3,787.4 billion by the end of 2028.

In the United States, food service delivery revenue is anticipated to amount to $174.3 billion by the conclusion of 2023.

The global food delivery mobile app market is expected to reach $16.6 billion in 2023. Online ordering marked a significant breakthrough.

“`html

Pizza Hut was the pioneer in offering online ordering for pizza restaurants.

In 1994, they also introduced the first mobile application, enabling customers to place orders and engage in built-in games as they awaited their food.

A survey indicated that 23% of restaurants believe that customers now show more interest in online ordering than they did prior to the pandemic, prompting a shift towards online ordering and increased digital marketing efforts.

According to Square’s survey, customers seem to favor placing food orders through their company’s app rather than through third-party services.

With online ordering systems, businesses can readily access customer feedback. They can easily modify the page layout and images of food items to assess customer reactions and make necessary menu adjustments to boost sales.

Conclusion

The statistics available indicate that the online food ordering market is expanding and is expected to continue growing in the immediate future.

While businesses are competing fiercely to excel as the premier food delivery application available, we believe that the greatest advancements are still to come.

The online food ordering landscape has swiftly transitioned from traditional delivery methods to innovations such as drones and cryptocurrency payments, according to the discussed statistics.

What do you anticipate the next evolution will be? At this point, all we can do is wait and watch.

Until then, happy online food ordering!

[3px] border-t-[3px] p-4 border-[#1d598f] my-4″ style=”box-shadow: 0 0 14px rgb(9 38 66 / 8%);”>

Sources

Who dominates US food delivery market?

DoorDash won the largest share in the US food delivery market over UberEats in 2020, with DoorDash capturing 45% of the market. While UberEats held 22%, Grubhub had 18%, and Postmates 8%. Their ascent was notably swift.

How big is the online food delivery market?

The global online food delivery market was valued at USD 189.70 Billion in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 10.8% from 2022 to 2028.

Which age group orders the most food?

Even though not all restaurants provide food delivery, various food delivery apps and websites allow for online orders. Based on statistics, the 18-24-year-old demographic orders the most food, closely followed by the 25-34-year-olds at 30%.

How many people order food online in Australia?

In 2020, 5.5 million Australians made use of food delivery services. The takeout food services in Australia doubled, increasing from 3.9 million in 2019 to 5.5 million in 2020.

“““html

How many people order food online in the US?

Over 112 million Americans have utilized food delivery services. The online food delivery market generates more than $26.5 billion in the United States.

Do people prefer ordering food online?

Services are reliable and swift. Online orders and takeout services focus on customer satisfaction. They aim to deliver excellent service, ensuring your food arrives hot and on time, alongside outstanding customer service and prompt communication.

Why is online food ordering popular?

It offers Convenience and Simplicity; all it takes is scrolling through the app to select your favorite meal, then simply tapping to order. These straightforward services are not just convenient but also quite comforting.

Interesting Online Food Ordering Statistics For 2024 That You Need To Know

Data is collected from 2023 and 2024, with forecast data extending into 2025 and 2026. We further broaden the forecast data to include 2027 and 2028.

* This information was taken from various sources around the world, including these countries:

Australia, Canada, USA, UK, UAE, India, Pakistan, Philippines, Indonesia, Nigeria, Tanzania, Kenya, US, United Kingdom, United States of America, Malaysia, U.S., South Africa, New Zealand, Turkey, United Arab Emirates.

Afghanistan, Albania, Algeria, American Samoa, Andorra, Angola, Anguilla, Antarctica, Antigua and Barbuda, Argentina, Armenia, Aruba, Australia, Austria, Azerbaijan.

Bahamas, Bahrain, Bangladesh, Barbados, Belarus, Belgium, Belize, Benin, Bermuda, Bhutan, Bolivia, Bosnia and Herzegovina, Botswana, Bouvet Island, Brazil, British Indian Ocean Territory, Brunei Darussalam, Bulgaria, Burkina Faso, Burundi.

Cambodia, Cameroon, Canada, Cape Verde, Cayman Islands, Central African Republic, Chad, Chile, China, Christmas Island, Cocos (Keeling Islands), Colombia, Comoros, Congo, Cook Islands, Costa Rica, Cote D’Ivoire (Ivory Coast), Croatia (Hrvatska), Cuba, Cyprus, Czech Republic.

Denmark, Djibouti, Dominica, Dominican Republic, East Timor, Ecuador, Egypt, El Salvador, Equatorial Guinea, Eritrea, Estonia, Ethiopia, Falkland Islands (Malvinas), Faroe Islands, Fiji, Finland, France, Metropolitan, French Guiana, French Polynesia, French Southern Territories.

Gabon, Gambia, Georgia, Germany, Ghana, Gibraltar, Greece, Greenland, Grenada, Guadeloupe, Guam, Guatemala, Guinea, Guinea-Bissau, Guyana, Haiti, Heard and McDonald Islands, Honduras, Hong Kong, Hungary, Iceland, India, Indonesia, Iran, Iraq, Ireland, Israel, Italy.

Jamaica, Japan, Jordan, Kazakhstan, Kenya, Kiribati, North Korea, South Korea, Kuwait, Kyrgyzstan, Laos, Latvia, Lebanon, Lesotho, Liberia, Libya, Liechtenstein, Lithuania, Luxembourg.

Macau, Macedonia, Madagascar, Malawi, Malaysia, Maldives, Mali, Malta, Marshall Islands, Martinique, Mauritania, Mauritius, Mayotte, Mexico, Micronesia, Moldova, Monaco, Mongolia, Montserrat, Morocco, Mozambique, Myanmar.

Namibia, Nauru, Nepal, Netherlands, Netherlands Antilles, New Caledonia, New Zealand (NZ), Nicaragua, Niger, Nigeria, Niue, Norfolk Island, Northern Mariana Islands, Norway.

Oman, Pakistan, Palau, Panama, Papua New Guinea, Paraguay, Peru, Philippines, Pitcairn, Poland, Portugal, Puerto Rico, Qatar, Reunion, Romania, Russia, Rwanda, Saint Kitts and Nevis, Saint Lucia, Saint Vincent and The Grenadines, Samoa, San Marino, Sao Tome and Principe.

Saudi Arabia, Senegal, Serbia, Seychelles, Sierra Leone, Singapore, Slovakia, Slovenia, Solomon Islands, Somalia, South Africa, South Georgia and South Sandwich Islands, Spain, Sri Lanka, St. Helena, St. Pierre and Miquelon, Sudan, Suriname, Svalbard and Jan Mayen Islands, Swaziland, Sweden, Switzerland, Syria.

Taiwan, Tajikistan, Tanzania, Thailand, Togo, Tokelau, Tonga, Trinidad and Tobago, Tunisia, Turkey, Turkmenistan, Turks and Caicos Islands, Tuvalu, Uganda, Ukraine, United Arab Emirates (UAE), UK (United Kingdom), USA (United States of America, U.S.), US Minor Outlying Islands.

Uruguay, Uzbekistan, Vanuatu, Vatican City State (Holy See), Venezuela, Vietnam, Virgin Islands (British), Virgin Islands (US), Wallis and Futuna Islands, Western Sahara, Yemen, Yugoslavia, Zaire, Zambia, Zimbabwe.

Interesting Online Food Ordering Statistics For 2024 That You Need To Know

September 13, 2024

“`

Author :

Publish date : 2024-09-18 23:31:00

Copyright for syndicated content belongs to the linked Source.

—-

Author : theamericannews

Publish date : 2024-09-19 12:56:24

Copyright for syndicated content belongs to the linked Source.